Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

In forex trading, currency movement tells a lot about the market condition. It allows traders to know whether they should open or close a trading position. This means understanding forex correlation pairs is crucial as it helps you see the level of risk in the market.

When you understand how to use correlated pairs and how they affect the market, trading will be easier for you.

Unfortunately, most traders still find it hard to understand them. This is why this article is here to help you understand forex pair correlation, how to trade using them, and the best tips to use while dealing with correlated forex pairs.

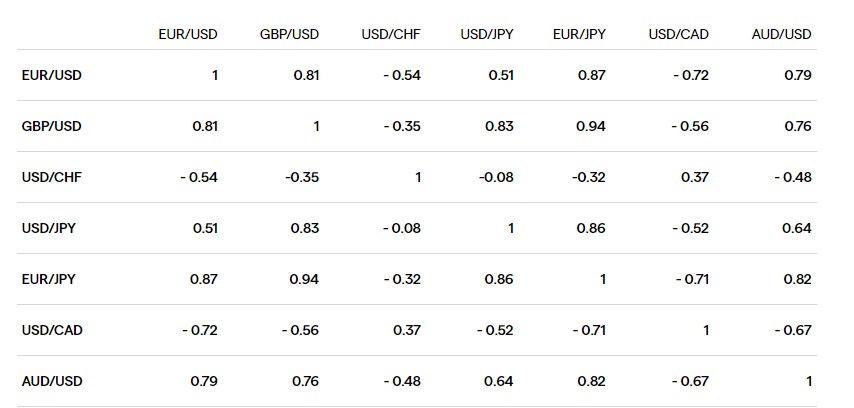

Correlation is usually computed into a correlation coefficient. This represents how weak or strong two forex pairs are. They are expressed in numbers or values that range from -1 to 1 or -100 to 100.

A positive correlation of +1 means that two currency pairs will identically move in the same direction. While a negative correlation of -1 means that the two forex pairs will identically move against each other.

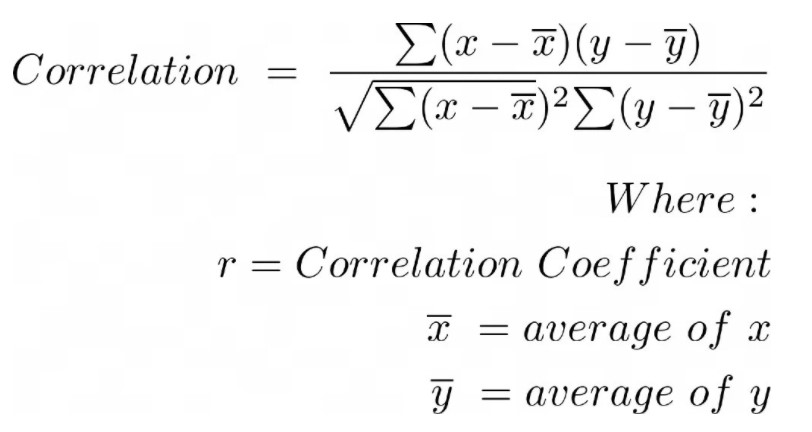

Reading charts and currency pairs correlation table is also crucial as it helps understand how correlation functions. A reading that is less than -70 and more than 70 means a strong correlation.

On the other hand, if a reading ranges in -70 and 70, it means that currency pairs are not strong or less correlated. The formula below explains well how the correlation coefficient is calculated.

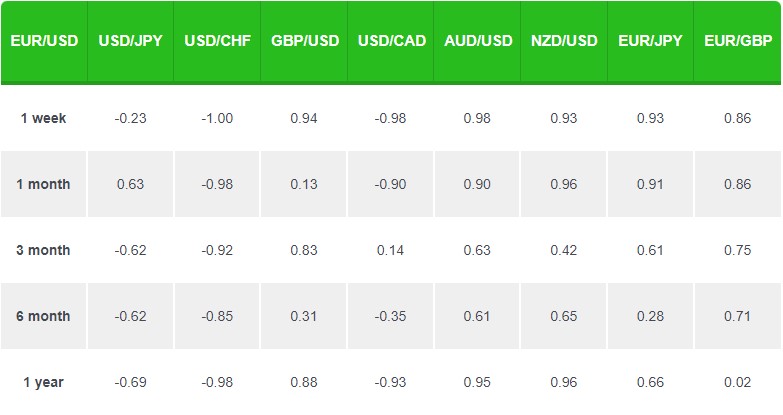

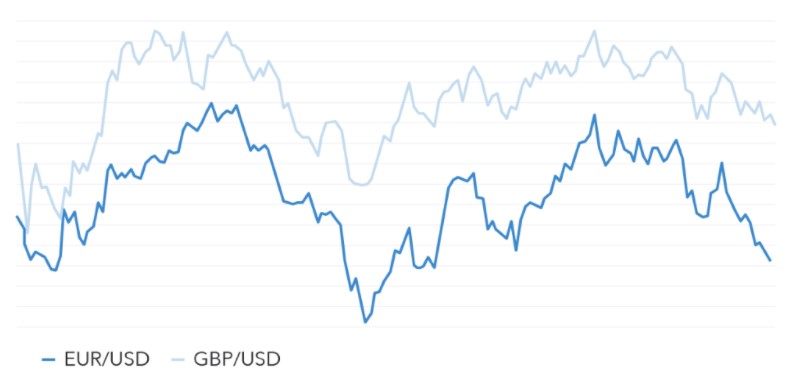

Highly positive correlated pairs are considered to have the same economic ties. They include;

This is one of the many forex pairs that correlate. The forex pairs increase and decrease are often viewed as equals. They correlate so well because of their relationship with the US dollar, the pound, and the Euro. All three currencies are intertwined by their strong economic ties.

When trading with this two currency pair correlation, you can open two long positions since both currencies move in the same direction. If both the EUR/USD and GBP/USD increase in price, you can potentially make better profits with the two forex correlated pairs.

Alternatively, you can go short if you predict one currency pair will fall earlier than the other. If one fails, most likely, the other will follow alongside the previous currency pair.

These are pairs that usually take the opposite direction. One familiar pair is;

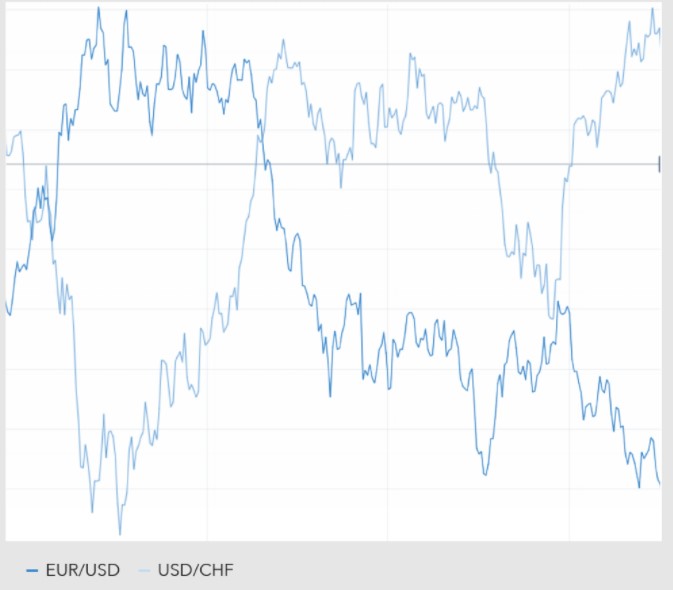

When it comes to this forex currency pair correlation, the USD/CHF usually moves against the EUR/USD. Its negative correlation ranges below -0.70 and sometimes goes further below -0.97. Effective traders typically take advantage of this negative correlation and hedge in one of the present pairs.

A good example is when you go long on both the EUR/USD and USD/CHF, despite their negative correlation. This helps protect you against the short-term volatility that may occur in the market. Again, any gains in the long position will offset the losses that might happen in the other opposite currency.

Forex correlation pairs offer a lot of trading advantages. Wise traders can use them to hedge and in commodity correlations. All you need to do is differentiate the positively correlated pair and negatively correlated pairs before using them in your trade.

The following steps will help you trade confidently using correlated pairs;

Yes, you can trade with correlated pairs so long as you understand how they work. Also, you can practice using them before switching to live accounts.

You can make better profits with correlated pairs if you apply them appropriately.

Forex pairs do not only correlate with other pairs. They also correlate with commodities such as gold, crude oil, etc.

Matthew is the Head of Operations at AudaCity Capital. He graduated from The University of Hertfordshire with a distinction in Finance and Investment Banking (MSc) and has dedicated his post graduate life to the FX markets.