Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

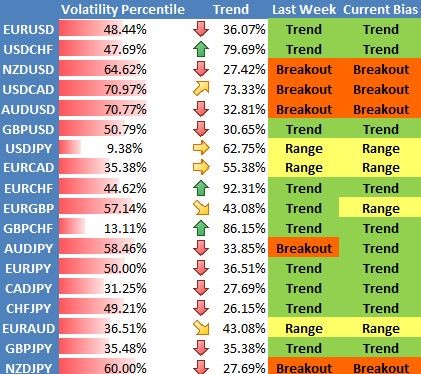

When trading trending Forex pairs, you can trade based on breakout trades or their trend continuation.

A common strategy in the foreign exchange market is to exploit strong currency trends. Each pair falls into one of three categories, namely exotic, minor or major, based on trading volume, liquidity, or volatility criteria. So, how do you identify what Forex pairs that trend best? Read on!

You must pay attention to market behaviour if you’re employing a breakout trading strategy and you’re looking for Forex pairs that trend best. Trends are driven by macroeconomics that tends to play out over specific periods, manifesting through commodity block or major pairs of currencies. While you can trade breakouts or trend continuation avoid mean reverting markets, otherwise you suffer consistent losses.

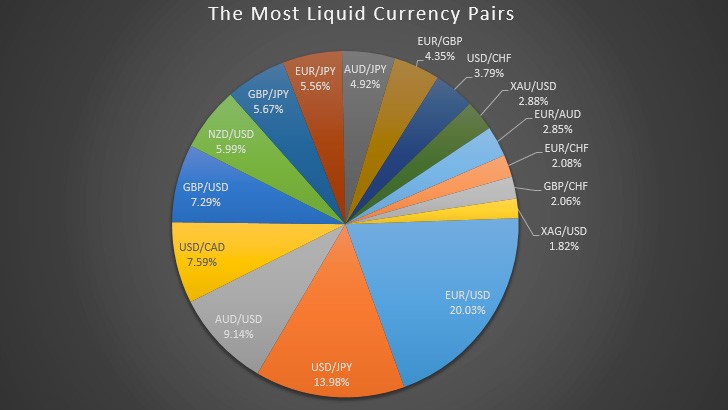

The most liquid or active currencies in the world belong to the US, the EU, UK, Switzerland, and Japan. Here tradition applies, seeing as the British economy isn’t backed by larger GDPs than India, Russia, or even Brazil. But since it was the first economy to develop sophisticated markets, the sterling pound was once the world’s reserve currency.

Like London is a primary centre of global Forex trading, Switzerland’s franc is also considered a major currency. CHF is known as liquid gold or a haven in times of economic turmoil or stagflation due to the country’s famed fiscal prudence and world politics neutrality. But the most liquid financial instrument is the EUR/USD pair, trading almost $1 trillion notional value daily.

Diversifying reserves by many central banks into the Eurozone also helps shifts or events that affect the Forex market. Together with the US, the EUR/USD currency pair represents the world’s largest economy. One of the keys to successfully trading such trending pairs is having a long-term outlook.

If you’re interested in following trends, you’ll identify a currency pair with more uptrend or downtrend than others. That makes sense for a trader trading in short time frames, say an hour, than those who wait out the long term. But short terms form too many false trade setups, making it hard for you to locate price moves for pairs that work.

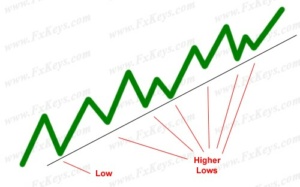

While some currency pairs form stable, longer trends compared to others, these are mainly trade-able in the long term. You’ll be looking for two types of trends, namely;

Uptrends form when the price goes up and creates higher lows, which are higher than the previous.

Downtrends create lower highs or those that are lower than previous highs.

It’s not easy to distinguish a trending market, mainly because of strange price behaviours even on long time frames. To easily locate trends, traders use some indicators or tools that help distinguish the price movement of trending currency pairs. The most famous of these indicators are the Simple Moving Averages, and the 20SMA, the 50SMA, and the 200SMA are the most common.

SMAs give you a mathematical depiction of the start of an obvious currency pair trend. For instance, the Golden Cross happens when the 50SMA moves above the 200SMA, indicating an upward trend. Its opposite is the Death Cross, when the 50SMA crosses below the 200SMA, showing the development of a downward trend. You can tell that a currency pair is forming a trend to tailor a flowing to your strategy is through volatility.

A common strategy in the foreign exchange market is to exploit strong currency trends. Each pair falls into one of three categories, namely exotic, minor or major, based on trading volume, liquidity, or volatility criteria. So, how do you identify what Forex pairs that trend best?

While trend detection is personal, there are ways to identify excellent trending behaviour of currency pairs. To determine if a pair is trending, you’ll employ several indicators and approaches while sorting out strong, weak, unstable, or angular and smooth trends.

Since most traded pairs include the US dollar, it’s best to watch EUR/USD, USD/JPY, and GBP/USD. It’s also essential to consider the periods you’ll be trading on to detect existing trend directions. Read on to learn how to calculate price changes using logarithmic moving averages for uptrends and downtrends to find the best trending Forex pairs.

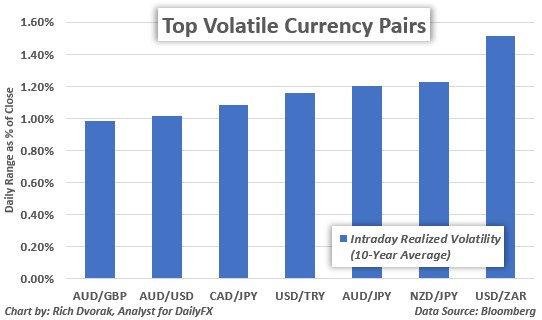

Currency volatility gives you an idea of how much movement a pair could make in any specified period. It’s calculated by measuring the standard variance or deviation of price movements. You can gauge volatility by looking at a pair’s range as a percentage of spot or its true average range.

When you spot a high level of currency pair volatility, it means that the degree of risk is also higher and vice versa. Risk and volatility are used interchangeably, but you’ll find volatile pairs at different levels on average. The potential rewards of trading these are significant, but so are the risks, and you should reduce your position size when dealing with volatile pairs.

As a strategy, you can combine the moving average crossovers with price fluctuations throughout a period, say a day, to confirm a trend. You’ll trade currency pairs as a single instrument, and the rate of exchange is the price to focus on as it generates profits from market fluctuations. These prices behave much the same way as stock prices during market volatility, and you’ll profit from movements by taking long or short positions.

The Forex market’s three most liquid commodity currency pairs are USD/CAD, AUD/USD, and NZD/USD. The Canadian dollar, CAD, is also known as the loonie, the Australian one, AUD is the Aussie, while the New Zealand dollar, NZD, is the kiwi. As tremendous exporters of commodities, the three nation’s currencies often display strong trends regarding the demand of their exports.

For instance, Canada is the largest exporter of crude oil to the US, and 10% of its GDP is within the energy exploration sector. The CAD’s strength creates a downtrend in the USD/CAD pair, trading inversely. On the other hand, Australia doesn’t have oil reserves but is the second largest gold exporter worldwide.

Majors and commodity block currencies trade the strongest, offering the longest trending opportunities. However, the best range-bound trades are also provided by currency crosses which are currency pairs without the USD as part of their pairing. One such cross is the EUR/CHF, which is by far the best range-bound pair due to similarities in the growth rates of the Eurozone and Switzerland.

Both these regions adhere to fiscally conservative policies while running current account surpluses. If you follow range trading trends, you can determine a pair’s range parameter by the high or low price fluctuations. Use these parameters to divide the median lime and buy or sell below and above.

When using the range-bound strategy, you’ll find that cross-currencies become attractive due to their representation of pairs from economically and culturally similar ecosystems. As such, an imbalance between such a pair returns to equilibrium seeing as one can’t go into recession while the other expands.

Since currencies depend on macroeconomic movements, they aren’t susceptible to risks such as individual company stocks occurring at the micro economy level. But the risk is still present in all forms of speculation, and you shouldn’t range a trending pair without stop loss. Employ a reasonable stop at the half amplitude of that pair’s entire range, stopping before the range is broken.

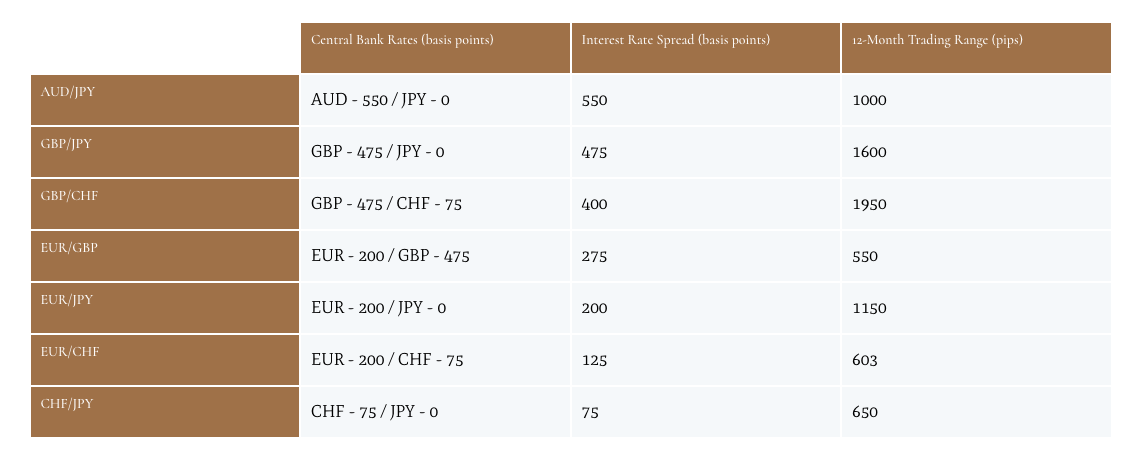

Variations in interest rates are why there’s a difference in the tight range of the EUR/CHF currency pair compared to the larger range of the GBP/JPY. The trading range of these pairs is affected by the interest rate differential between the two groups of nations.

Here are various crosses with interest rate differentials and their maximum trend or pip movements from high to low over the same 12-month trading range.

You must pay attention to market behaviour if you’re employing a breakout trading strategy and you’re looking for Forex pairs that trend best. Trends are driven by macroeconomics that tends to play out over specific periods, manifesting through commodity block or major pairs of currencies. While you can trade breakouts or trend continuation avoid mean reverting markets, otherwise you suffer consistent losses.

The most liquid or active currencies in the world belong to the US, the EU, UK, Switzerland, and Japan. Here tradition applies, seeing as the British economy isn’t backed by larger GDPs than India, Russia, or even Brazil. But since it was the first economy to develop sophisticated markets, the sterling pound was once the world’s reserve currency.

Like London is a primary centre of global Forex trading, Switzerland’s franc is also considered a major currency. CHF is known as liquid gold or a haven in times of economic turmoil or stagflation due to the country’s famed fiscal prudence and world politics neutrality. But the most liquid financial instrument is the EUR/USD pair, trading almost $1 trillion notional value daily.

Diversifying reserves by many central banks into the Eurozone also helps shifts or events that affect the Forex market. Together with the US, the EUR/USD currency pair represents the world’s largest economy. One of the keys to successfully trading such trending pairs is having a long-term outlook.

While trend detection is personal, there are ways to identify excellent trending behaviour of currency pairs. To determine if a pair is trending, you’ll employ several indicators and approaches while sorting out strong, weak, unstable, or angular and smooth trends.

Since most traded pairs include the US dollar, it’s best to watch EUR/USD, USD/JPY, and GBP/USD. It’s also essential to consider the periods you’ll be trading on to detect existing trend directions. Read on to learn how to calculate price changes using logarithmic moving averages for uptrends and downtrends to find the best trending Forex pairs.

Forex pairs do not only correlate with other pairs. They also correlate with commodities such as gold, crude oil, etc.

Matthew is the Head of Operations at AudaCity Capital. He graduated from The University of Hertfordshire with a distinction in Finance and Investment Banking (MSc) and has dedicated his post graduate life to the FX markets.