Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

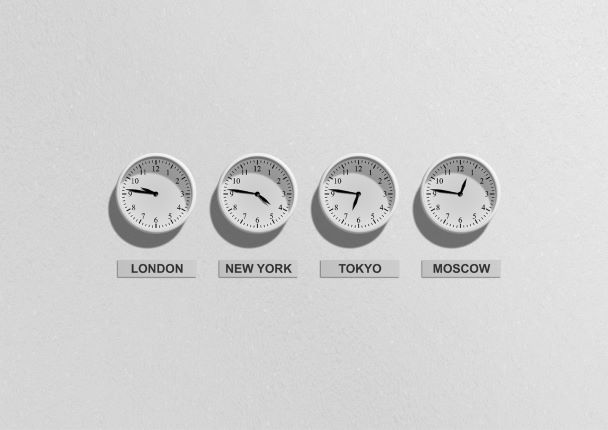

Forex traders have access to four trading sessions during every twenty-four-hour period. These sessions tend to overlap throughout the day due to varying time zones.

Today, you’ll learn about the New York session, which occurs when the US markets open. Some traders refer to it as the “North American” trading session.

As a currency trader, you need to know which currency pairs and opportunities you should focus on during your trading session. Below is a detailed guide to get you started.

Many forex trading newbies make the mistake of hitting the market running. Some begin by watching various economic calendars before trying to trade all day long.

While the five-day, 24 hours day foreign exchange market makes this a possibility, there’s a need to devise a better trading strategy. A poor strategy like this one will deplete your reserves fast!

Before going any further, you’ll need to understand that Wall Street and the Forex market are different entities. One runs during regular business hours while the other operates during the normal business hours in four different time zones/parts of the world.

And this means that trading can last all day and night. Gaining an understanding of when the market opens means you don’t have to stay up all night. It’s a strategy that allows you to set up the right trading goals, boosting your chances of maximizing your profits.

The EUR/USD is one of the most traded major currency pair worldwide.

Furthermore, the European session usually overlaps with the starting hours of the New York session, which means institutions and European traders are continuously buying and selling it.

Based on this, it means you’re likely to encounter high liquidity and an abundance of opportunities during this session.

Another pairing to trade during the New York session is the GBP/USD pairing, as the London session overlaps with the New York session.

The overlap is much longer than that of the European session. Experienced traders love this pairing because it acts as an excellent barometer of prevailing economic health between the UK and the US.

During the New York Session, a great trading strategy is to consider the trending currency pairs. While such a strategy will significantly improve their profits, it can also attract high risks.

In such cases, the market tends to move quite strongly. The trader will need to revise and analyze their trading strategy continuously. And this is not forgetting the constant need to adapt to sudden price movements and changing market conditions.

Trading such pairs can lead to a trader canceling out their preferred long-term trading strategy, e.g.,

In some cases, a trader may even stop their order(s) execution. Often, the system doesn’t execute the orders at the trader’s preferred price range.

All these happen when there are price slippages and other trading scenarios occasioned by high volatility. You should expect to encounter such scenarios when important economy-related data is about to be released.

Currency pairs attract wide price ranges when a trading overlap between the New York and London trading sessions occurs.

The increased price ranges are due to the involvement of more investors. An overlap leads to huge price movements, necessitating the use of the breakout strategy.

Most currencies in the forex market are traded and quoted against the US dollar before getting converted to other currencies. Consequently, if you want to convert a Japanese Yen into the British pound, you must first trade it against the dollar and then the British pound.

The New York session is the second-largest worldwide thanks to its large volume, making it profitable for experienced investors. The crossover between the New York and London sessions also means investors can access many good opportunities.

A look at the currency pairs mentioned above shows that some currencies appear numerous times. Today, the most traded currency pairs include the USD/CHF, EUR/USD, GBP/USD, and USD/JPY.

Forex markets such as the New York trading session use the same currency pairs used by other exchanges worldwide, allowing them to operate 24/7 as they are international. On the other hand, stock markets typically list and trade the shares issued in a given country.

The London session is the most volatile of the four because of the many transactions passing through it. Volatility increases when an overlap occurs between the New York and London sessions. The most volatile days for the major currency pairs are Tuesday to Thursday.