Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

Forex trading requires consistency, patience and you must also have the best strategies to win in the market. But above all, you need to make a good decision on which currency pairs you will trade. This is because forex pairs usually affect the trading strategy and risk management.

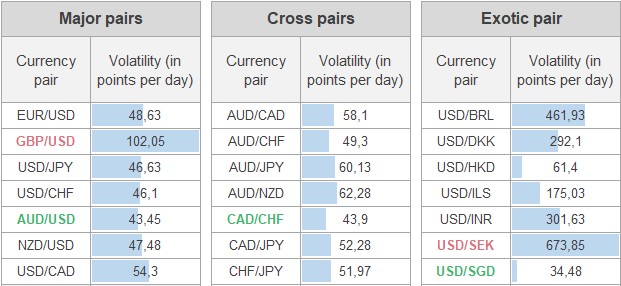

When choosing currency pairs, you need to think about a few factors, like volatility. Not all currency pairs have the same volatility, some are considered the most volatile currency pairs than others, and there is a reason for that.

The most volatile forex pairs can give your more profits or bigger losses. Because of this, you need to be very careful when picking them. Here in this article, you will learn more about volatility, how it comes about, and some of the most volatile currency pairs available.

Volatility is used a lot in forex trading, and if you would like to start trading, it is crucial to understand this term. Volatility is the frequency at which your currency pair fluctuates and is usually calculated by determining the variance or the standard deviation of forex price movement.

This information is usually crucial to traders and investors as it helps them predict other investment opportunities and how a currency will move over time. The most volatile forex pairs fluctuate significantly within a given period, while the least volatile ones undergo minor price movements. This is why it is possible to make huge profits with forex most volatile pairs if you have a good trading strategy.

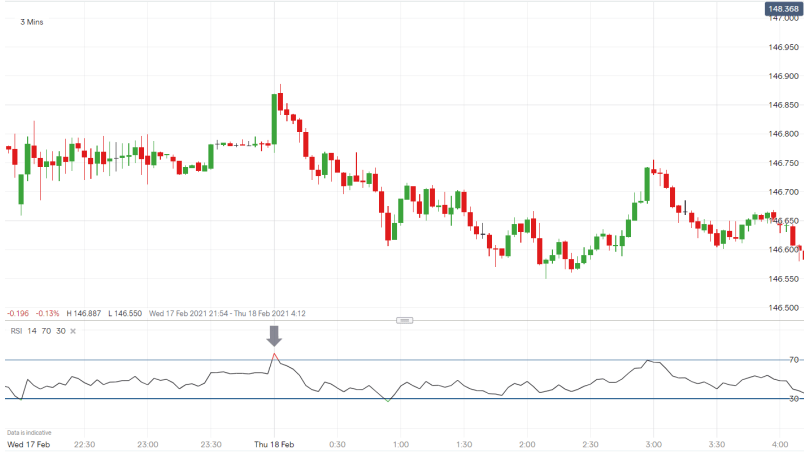

Volatility is typically based on both the base and quote currency. If one of them is triggered by specific events, the currency pair will fluctuate a lot. Such events may include geopolitics, interest rates, etc. The image below clearly illustrates the high volatility between the EUR/AUD currency pair.

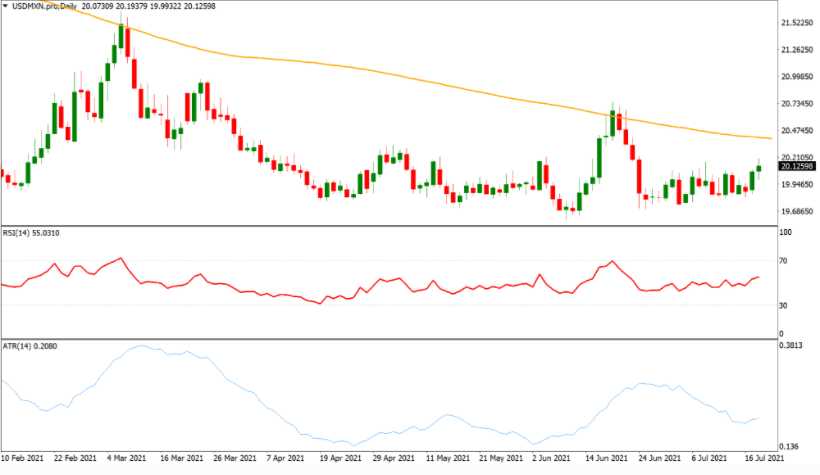

As mentioned earlier, when a currency pair is triggered by certain events it will fluctuate. Some of the things that can cause this fluctuation include:

The supply and demand of commodities, for example metals, oil and minerals can make a forex pair to change a lot in a given period.

Political factors can also influence the forex market. When heavy tariffs are imposed on exports or imports, it contributes to volatility.

The most volatile currency pairs are also affected by some market indicators that can be used to predict economic performance. They may include inflation, availability of commodities, outputs and unemployment rates.

The British pound against the Australian dollar is a volatile cross pair. Since the Australian dollar is a commodity currency and there have been trade wars with China, the markets have collapsed, making this pair highly volatile.

The USD/ZAR is the US dollar vs. the South African rand pair. It is one of the forex pairs that move the most as the price of gold impacts it. South Africa exports gold as one of its main commodities, and because gold is priced in the US dollar, it is greatly affected by how the USD strengthens or weakens.

So, this means that if the gold appreciates, so does the USD. This is great for South African exporters as they will make more US dollars, but it will disadvantage those who want to purchase USD with ZAR. This is why traders must analyze the price of gold before trading with this pair.

There is no specific answer to this question because many currency pairs are affected by volatility. It should depend on the opportunity you are looking for. If you want to make high profits, volatile forex pairs will be suitable as price fluctuations are high. But also remember they are risky, which means you must polish your trading strategies.

Most volatile currency pairs follow specific rules. This means you must always stay ahead of the curve if you want to be a successful trade. Always follow the big news events that might affect currency prices, apply risk management strategies and understand more about the latest forex pair analysis.

Price movements are not a bad thing in the forex market as it determines if traders will make profits—the high the volatility, the high the chances of making more money. The only downside to high volatility is higher risk.

Matthew is the Head of Operations at AudaCity Capital. He graduated from The University of Hertfordshire with a distinction in Finance and Investment Banking (MSc) and has dedicated his post graduate life to the FX markets.