Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading for Beginners

The Forex market may appear abstract, intimidating, and complex for a beginner trader. But its underlying mechanism is intrinsically simplistic and straightforward. Essentially, you buy high or sell low and vice versa when exchanging one currency for another. Keep reading this beginner’s guide to Forex trading for deeper insights.

At first, I advise opening a practice or demo account with your Forex trading guide brokerage or online platform. While this gives you access to the market, if you’re impatient, then you can open your first trade at the current price level. It’s what’s called entering at current market price, after which you’ll indicate stop loss, take profit and quantity to trade, or position size.

The standard currency pair quotation system involves two currencies listed using three-letter abbreviations. The first or base currency is on the left, while on the right is the quote currency. There’ll be two prices for each pair in a two-way quote system for buying and selling currencies, and the bid and the asking price.

Placing a Forex order involves giving your broker or brokerage software commands showing the currency pair to buy or sell. You’ll indicate the direction of trade, whether short or long, and the price to trade. Trade orders tell the platform the quantity to buy, where to deposit that profit, or when to exit the trade.

In both instances, the market needs to go either up or down for you to make a profit. That’s true whether you bought weak to sell strong or you shorted the market, waiting for the price to fall.

When you open a trade, your broker puts up a certain amount of your account balance as collateral. That’s a deposit called the margin requirement, which isn’t a full position size but a fraction to cover possible losses. The margin is locked up while your trade is active and only freed once the position is closed, enabling you to execute larger trades than you can otherwise afford.

These margin requirements depend on;

You’ll also choose desired technical indicators to set trade entry and exit points. Several aspects can also be blended, resulting in your preferred strategy. Some common Forex trading strategies include;

You can hold multiple short-term trades and build profit on frequent but small winning trades. The strategy is best suited when you can commit a large time proportion and focus on the technical analysis of currency pairs.

You can enter and exit one trade per day to avoid overnight holding costs by predicting daily market movements. Use this strategy if you aren’t comfortable with the fast-paced Forex scalping method and prefer short-term trading methods.

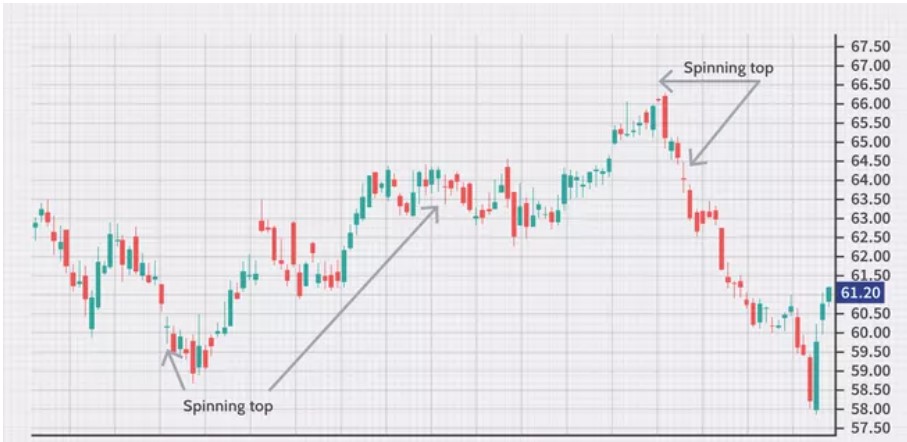

If you prefer a balance between technical and fundamental analysis, use the swing trading strategy. Your position will be open for several days, and the aim is to buy swing highs or swing lows, or vice versa. You spend less time analysing market trends, but there’ll be more changes of a gapping market plus overnight holding costs.

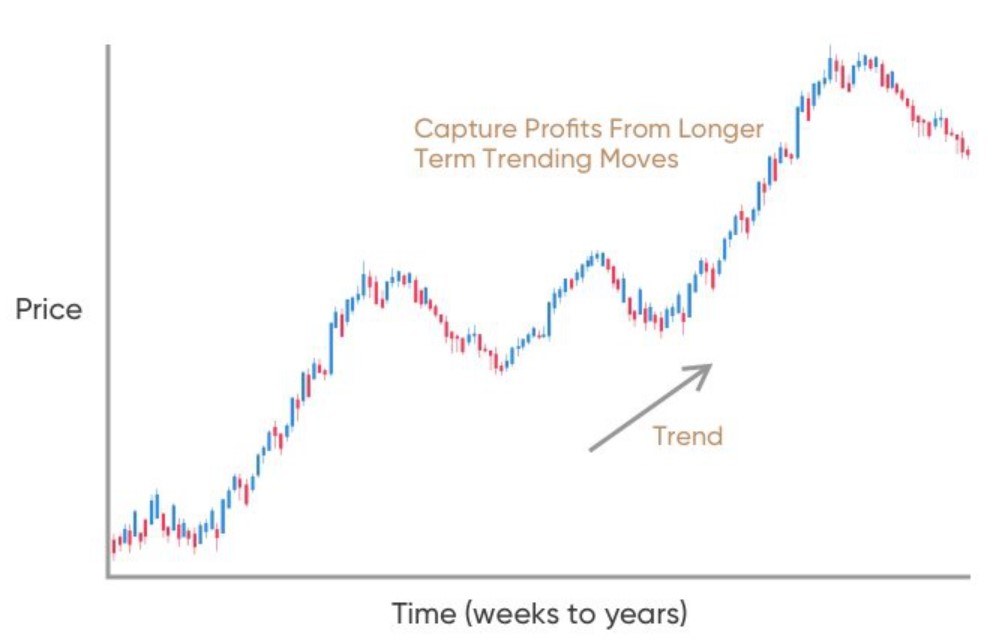

You can also ignore short term price fluctuations and hold positions for long term periods in position trading strategies. Use this Forex trading strategy if you spend lots of time understanding market fundamentals and less time executing trades or undertaking technical analysis.

Forex trading is converting one currency unit into another. The most commonly traded currencies include the US dollar, USD, the British pound, GBP, and EUR. Other significantly exchanged are the Australian and Canadian dollars or AUD and CAD, respectively, plus the Japanese yen, JPY.

Through your Forex broker, you’ll place an order for a currency pair. These are pairs of currencies that you’re planning to swap, and each has a different exchange rate. For instance, if the price states the EUR/USD pair is exchanging at 1.1150, it means you can get 1 euro for 1.1150 US dollars. The rate, which denotes the currency you’ll buy or sell, requires this market’s arbitration.

For beginners, you’ll understand the currencies quoted and what their exchange rate represents in currency trading. You’ll decide which type of trade to make as they can be short or long trades depending on how much the cost is to you or the spread difference.

The spread difference is the remainder between the asking and bidding price, an essential aspect of making a profit in the Forex market. When you’re a beginner trader, you can engage in long and short trades and stay aware of the risk involved in dealing with complex products.

Ask and bid prices are what you see when you’re looking to start trading Forex for beginners. The asking price is which you’ll buy currency, while the bid represents the price you can sell.

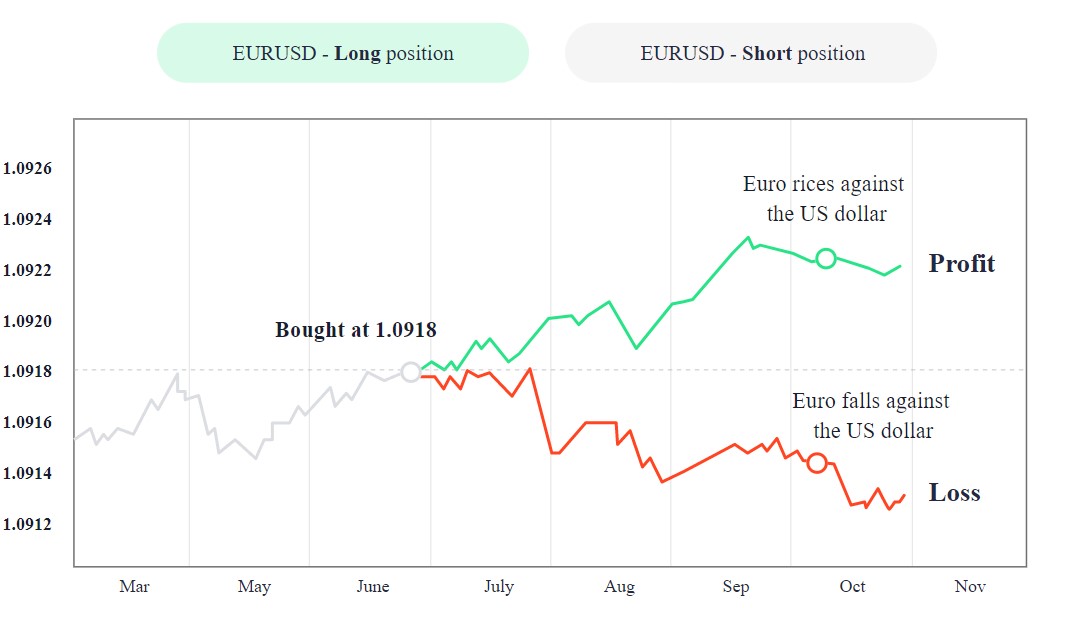

Long trades involve buying a currency with an expectation of its price increasing. As such, when you sell, you’ll make a profit between its purchase and sale price.

Brokers profit from the difference between the sell and buy prices of currency pairs, also called the spread. Exchange prices are also determined by how liquid a unit is or how many units are moving simultaneously.

Short trading is selling a currency with the expectation of its price decreasing, and then you can repurchase it at a lower value. In this type of trade, you speculate to make a profit on the price differences.

When learning how to trade Forex for beginners, the price you’ll trade a currency is based on the current exchange rates. That means you’re targeting the amount you get from exchanging for a unit of the one you’re selling. For instance, if you exchanged 1 euro for 1.68 US dollars, your broker gives you a sale price that’s on either side of this cost.

The most liquid currencies have the highest demand and supply dynamics within the Forex market as currency pairs go. These metrics are generated by the unit-pair transaction activities of traders, banks, multinational entities, importers, and exporters. Currency pairs are also categorised according to how they trade against the US dollar, which plays an essential role in the FX space.

Major currency pairs, including EUR/USD and GBP/USD, trade against the American dollar, and they tend to be the most liquid. These provide the most opportunity for short-term trades. Minor and exotic currencies are those with less liquidity, and these, too, can provide opportunities. These include: EUR/JPY or EUR/GBP, seeing as they don’t trade against the US dollar.

Exotic currency pairs are also sometimes referred to as minor pairs, and they’re linked to emerging economies. These consist of the Turkish lira, the Brazilian real, and the South African rand.

Forex trading gives you access to some of the world’s largest financial currency markets, but that wasn’t always the case. The international nature of this system means that global events have shaped its development and the standards by which you trade FX today.

Back in 1871, governments established the Gold Standard monetary system. Before this, nations used gold or silver to settle payments after trading. The British banknote is one example of a promissory note, signed by the chief registrar and could be exchanged for an equal amount in sterling silver. Global trade changes significantly influenced these metallic commodities’ value and if somebody dug up ore from the earth.

The Gold Standard brought about a way to guarantee the value of currency conversion into a specific amount of this precious metal. That brought about control to trade methods, reduced marker volatility, and countries could benefit from a low inflationary environment. The first type of foreign exchange started when pitting price differences between one currency and another against an ounce of gold.

Fast forward through the 1st world war, the roaring twenties, and the UN’s Bretton Woods Conference in 1944 during the 2nd world war. The gold standards had failed, and a system of fixed exchange rates included the creation of economic activity overseeing agencies. They include the IMF or international monetary fund, the World Bank, and the World Trade Organization.

Author: Federica D’Ambrosio is a Senior Trader and Chief Financial Officer at Audacity Capital. She holds a Bachelor of Science degree in Finance from Luiss University and furthered her knowledge of global markets with a Master of Science degree from Fordham University in New York.

You roll up your shirt sleeves and do your research in any new endeavour. That due diligence is essential when you’re new to foreign exchange markets to speculate on currency price movements. So, what is involved in Forex trading for beginners?

Forex trading tutorial basics surround creating currency pairs and deciding how to trade while managing risk strategically. Once you’ve understood the technique, you’ll determine what type of trader you are. Depending on your trading style, you’ll either be a day, swing, or scalp trader.

You can test your methods and strategies using an FX demo account or Audacity Funded account when learning how to trade Forex for beginners. Brokerage platforms offer these to help you measure currency pair success rates and their suitability before opening a trade. You’ll need to know your markets and set up a trading plan you can stick to before you can make trade forecasts. Choosing the right broker also helps with practice, knowing your limits, steady trading, and accepting consistent growth.

The best strategies as a beginners are day trading, swing trading, scalping and position trading.

Depends of every trader the most popular is RSI and ForexFactory

Maintain a trade journal.

Calculate volatility, margin, and profit, among other things.

Calculate currency exchange rates

Maintain a financial calendar.

Receive financial news in real time.

Most of them are free or offered as service by the brokers.