Il trading Forex consiste nel convertire un'unità monetaria in un'altra. Le valute più comunemente scambiate includono il dollaro statunitense, l’USD, la sterlina britannica, la GBP e l’EUR. Altri scambi significativi sono i dollari australiani e canadesi o AUD e CAD, rispettivamente, più lo yen giapponese, JPY.

Attraverso il tuo broker Forex, effettuerai un ordine per una coppia di valute. Queste sono le coppie di valute che intendi scambiare e ciascuna ha un tasso di cambio diverso. Ad esempio, se il prezzo indica che la coppia EUR/USD viene scambiata a 1,1150, significa che puoi ottenere 1 euro per 1,1150 dollari USA. Il tasso, che denota la valuta che acquisterai o venderai, richiede l’arbitrato di questo mercato.

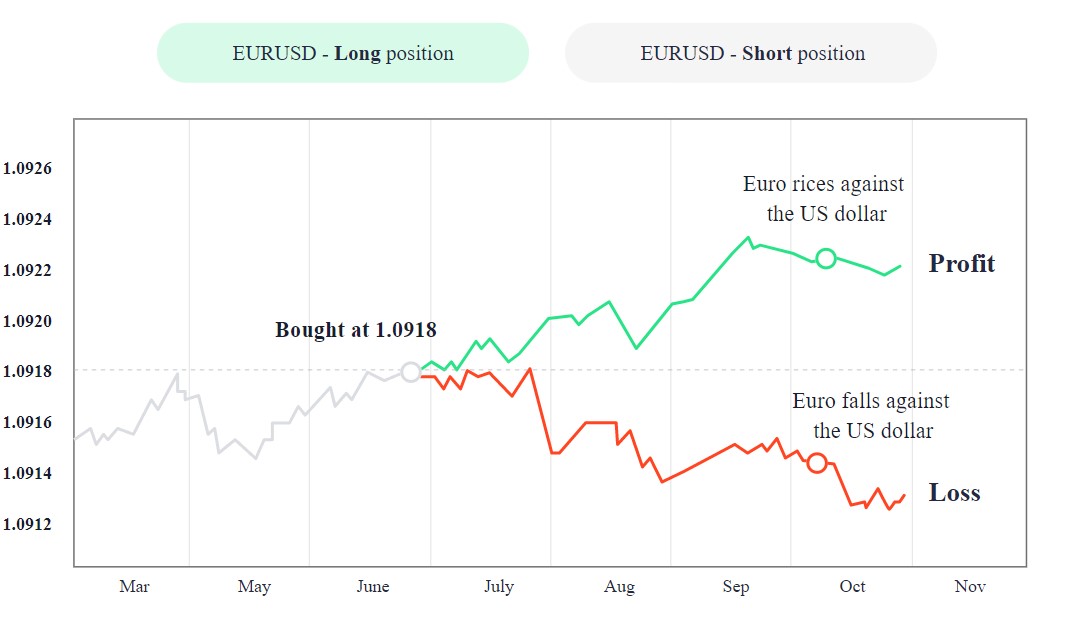

Per i principianti, capirai le valute quotate e cosa rappresenta il loro tasso di cambio nel trading valutario. Deciderai quale tipo di operazione effettuare in quanto possono essere operazioni brevi o lunghe a seconda di quanto ti costa o della differenza di spread.

La differenza di spread è il resto tra il prezzo richiesto e quello offerto, un aspetto essenziale per realizzare un profitto nel mercato Forex. Quando sei un trader principiante, puoi impegnarti in operazioni lunghe e corte e restarne informato il rischio coinvolto nella gestione di prodotti complessi.