Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading for Beginners

Forex trading is a fast-paced, high-risk business. You can be a winner, but you can also lose everything in seconds. Generally, there are many things to understand if you want to get into the forex market. Aside from trading strategies and risk management, you also need to know about forex trading tax.

If you are new to trading, you may think that the forex trading tax is something that isn’t important to you. You may think it’s only for the big players and traders making millions of dollars every month. This is not the case. If you want to trade, then you need to know about forex tax. This is because if you don’t pay your taxes on your profits from trading, you could be breaking the law.

Every country has its tax rules, which should be followed religiously by all citizens, whether you are working for the government or self-employed. When it comes to forex trading, one common question is: Is forex trading tax-free?

In the UK, you are liable for capital gains tax on profits made from foreign exchange transactions, as well as stamp duty on any gains made when selling your shares or property. When it comes time to pay this tax, you will need to know what your situation is and how much tax you owe. This guide will specifically look at forex trading tax UK laws and if it is necessary for all UK traders to pay their tax. Keep reading to gain more insight.

Do you pay tax on forex trading UK? Tax on forex trading UK is subjected to all traders earning a specific amount of money from their trade, but not all UK Forex traders need to pay tax. You can be a full-time or part-time trader and still be exempt from paying tax. Typically, there are two types of traders who do not need to pay taxes:

Day traders – These are traders who hold positions for less than one week. Day trading is not taxable because it qualifies as short-term trading on a small scale. Therefore, if you are still asking, “How can I avoid taxing on day trading UK” know that there is no set tax for this kind of trading.

Part-time traders – These are people who trade using automated systems and usually only make profits on the forex market once in a while. Part-time traders are unlikely to meet the HMRC (Her Majesty’s Revenue & Customs) conditions, and that qualifies them for being exempt from paying tax. The sections below will focus more on HMRC to help you understand forex trading tax laws in the UK.

The UK is one of the most tax-friendly countries in Europe, with a low-income tax rate and a flat corporation tax rate. However, it does have some tax duties that you should be aware of if you’re trading forex in the UK.

The UK’s tax system is based on five main taxes, which include;

Income tax is calculated by calculating your taxable income, adding your allowances, and subtracting any losses from previous years. You can claim allowances based on your marital status, number of children, and things like business expenses or gifts made to others. These are known as personal allowances. Normally, the income tax charged in the UK is lower than that in the United States.

If you are a Forex trader, you must pay corporation tax on your profits. This is because you are earning income from trading, and this is where the tax comes in. If you have profits of £50,000 or more, you will be liable to pay income tax at 20%. However, if your profits are less than £50,000, then there is no tax to pay. This is due to a special relief that allows traders who make less profits not to pay any income tax or capital gains tax in the UK.

Capital gains tax is an annual charge on any profit made on the sale of assets held for more than 12 months. The amount of the charge depends on how long you owned the asset before you sold it and whether it was held for personal use or as an investment. For example, if you buy a currency pair and then sell it for a higher price, you will have made a capital gain.

Other forms of taxes in the UK are inheritance tax and National Insurance Contribution. The two do not affect UK forex traders much, but they must still pay at some point if they live in the United Kingdom.

While it is important to know forex trading UK tax implications, it is also crucial to know where you fall as a trader. This will allow you to understand what to expect at the end of each year or month. Thankfully, the HMRC has clearly set its laws and regulations to help all traders know how much tax they need to pay from their forex trading profits.. It has classified traders into three main categories, including;

Speculative trading is the first category and involves all gambling activities. If you are a trader under this bracket, you are tax-free, meaning you are not subjected to any capital gain or income tax. Falling into speculative trading may seem like an advantage, but you will not be entitled to any losses you make since your income will not be taxed.

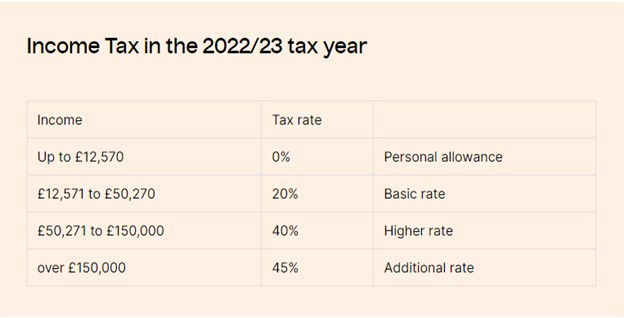

According to forex trading tax UK HMRC laws, self-employed traders will be taxed, depending on their business activities. If your total income is below £50,000, you will only pay 10% in capital gain tax. On the other hand, if it is more than £50,000, you will be subjected to a 20% capital gain tax. In short, you will be charged depending on your yearly income. Here is a simply 2022/2023 forex trading tax reporting showing tax rates according to specific tax brackets;

A private investor is the last category in the HMRC, and your gains, as well as losses, will be taxed under the capital gain tax. However, you need to know that you can fall in either of the above categories, depending on the trading activities.

Normally, you must have owned the asset for at least 12 months to pay the CGT tax. If you own it for less than 12 months, you’re exempt from paying CGT. Also, if you owned it for more than 12 months and then sold it within that period, you’ll be liable for CGT unless there are exceptional circumstances such as war or natural disaster.

Apart from these, the HMRC may consider asking you other questions to know how you should be taxed for your trades. If you find things are not very clear with your taxes, it is important to get a tax advisor or accountant to make this clearer and easier. Sometimes the UK tax laws on forex trading may get complicated, especially if you are a beginner. Therefore, it is wise to do more research and understand everything the HMRC would expect you to do if you are a trader.

The UK is a leading country in Forex trading, and many people want to get into this industry. It is not easy, but if you are committed, you can make your dream come true. The country has many Forex brokers, many currency pairs to trade, and a relatively good reputation as a safe jurisdiction.

Its main advantage is that it is an open market, which means that there are no restrictions on who can participate in trading activities. The UK also offers its residents freedom from regulation and security when trading on foreign exchange.

The country has plenty of forex brokers, and you can also use reputable prop trading firms like Audacity Capital to learn and earn forex profits. Also, when it comes to taxes, all UK traders are charged fairly as it mostly depends on your income and trading activities.

As much as that is the case, having a few UK tax tips is crucial to avoid falling into the wrong side of the law. Here are a few tips that will help;

As a forex trader, you will definitely have many trading activities throughout the year. That may vary between self-employed, speculative, and investments. This means that you should file your returns differently for all your accounts. Your records should consist of;

By keeping your trading records clear, you will have an easier time filling your returns. Tax consultants can also help you know how to file the right forex off taxes UK, as well as all the details you are required to have while filing your taxes.

UK forex trading tax laws are getting complicated, and a few things may change along the way without your knowledge. Therefore, it is important to seek professional advice and understand HMRC tax laws to make things easier for yourself.

Forex trading tax in the UK greatly depends on an individual’s yearly income and trading activities. The HMRC analyses a few things to determine how much tax you should pay at the end of each year.

If you are earning profits from your trades, you should pay taxes. However, there are a group of traders that are eliminated from tax charges, e.g., speculative traders, day traders, and part-time traders.