Forex trading is a fast-paced, high-risk business. You can be a winner, but you can also lose everything in seconds. Generally, there are many things to understand if you want to get into the forex market. Aside from trading strategies and risk management, you also need to know about forex trading tax.

If you are new to trading, you may think that the forex trading tax is something that isn’t important to you. You may think it’s only for the big players and traders making millions of dollars every month. This is not the case. If you want to trade, then you need to know about forex tax. This is because if you don’t pay your taxes on your profits from trading, you could be breaking the law.

Every country has its tax rules, which should be followed religiously by all citizens, whether you are working for the government or self-employed. When it comes to forex trading, one common question is: Is forex trading tax-free?

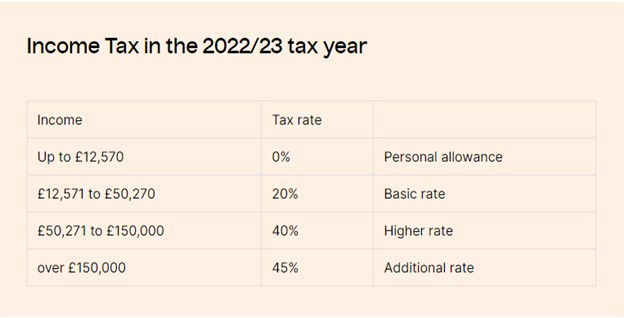

In the UK, you are liable for capital gains tax on profits made from foreign exchange transactions, as well as stamp duty on any gains made when selling your shares or property. When it comes time to pay this tax, you will need to know what your situation is and how much tax you owe. This guide will specifically look at forex trading tax UK laws and if it is necessary for all UK traders to pay their tax. Keep reading to gain more insight.