Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading for Beginners

If you are planning to make money with forex trading, it is important to know the ins and outs of the market to make it easy for yourself. Forex trading is not a get-rich-quick scheme. You have to put in a lot of research and time to know how forex works and how to generate income with this money-making strategy.

First, you need to learn about currency pairs, commodities, types of charts, risk management, trading strategies, and how to choose a forex broker, among many other things. Forex lot size and leverage are other things that should never be overlooked if you want to become a profitable trader. These things will determine how you will perform in forex trading.

The good news is that Audacity Capital provides its trader with resources where they can learn the basics of forex trading and begin trading successfully. Here is what Audacity Capital has to say about forex lot size and leverage;

A lot size is the number of currency units you choose to buy or sell in every transaction you make. When you open a trade, you must specify the size of the lot you want to trade with, and you can always change it depending on the amount you have.

To understand lot size, picture a million traders who want to purchase a certain financial asset. To fulfill all the buy requests from a million traders, you will need to standardize the requests or orders so that it is more convenient for everybody. In other words, lots are normally used to standardize the units of a sell or buy order.

In forex trading, a standard lot is equal to 100,000 units. However, traders do not have to purchase one standard lot. A lot can be any number of units.

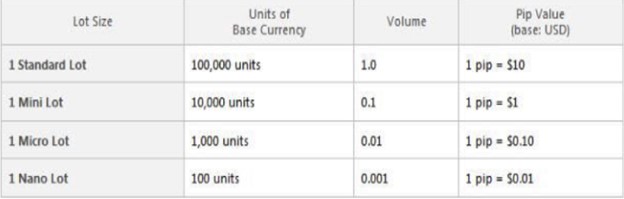

The types of lot sizes will also help you understand what a lot size is and how it can affect your trades. Here they are;

What leverage should a beginner use? To understand the best leverage for beginners, we must go back a little. Earlier, we said that the best lot size for a beginner is a micro lot, meaning you must at least have 1000 units to begin with this account. But if you cannot afford a $1000 account, you can always go for leverage of 1:10 if you have $100.

Let’s say for instance, you go for leverage of 1:1000 with only $100. This would mean you have 100,000 units to trade with, but you will have magnified your chances of losing money. Therefore, the best leverage for a beginner is 1:10, or if you want to be safer, choose a leverage of 1:1, depending on the amount you are starting with.

So, what leverage should I use on a $300 account? $300 is the minimum amount of money required in a mini lot account, and the best leverage on this account is 1:200. This would mean you will have $60,000 to trade with.

Other leverage you can use in forex trading include;

Forex leverage and lot size are terms that all forex traders must understand to trade successfully. The two have a connection, which makes the terms confusing for new forex traders. Here are some of their differences that will help you understand how to use them;

Definition: A lot size is basically the amount of currency units you buy or sell in every transaction. On the other hand, a leverage is the amount you borrow from your broker to the amount you own.

Representation: Forex lot size are mainly represented in currency units, for example 100,000 or 1000 units. On the other hand, leverage is represented in ratio, e.g. 1:10 or 1:1000.

Limit: The maximum lot size in forex trading is 100,000 units, which is the standard lot. The minimum is a Nano lot, which equates to 100 units. With leverage, you can choose up to 1:5000 and the least is 1:1. However, this mainly depending with the broker you are using.

Forex lot size vs. leverage go hand in hand, and you must understand how they work to trade successfully. If you want to trade with a micro lot account, choosing high leverage is not advisable, or you will be closed out.

It is crucial to understand that leverage is there to help you increase your returns and should be used with good risk management skills to minimize losses. Audacity Capital is here to provide you with all the resources to help you understand how leverage works and the best lot size to pick as a beginner.

Too much leverage can be very risky, especially if you are trading with a small amount of money. It is advisable to choose a 1:1 leverage if you are a beginner forex trader to avoid blowing your account.

Understanding lot size is important because they do affect profits. For example, if you choose a standard lot size, it means that for every 1 pip movement you will either lose or gain $10.

Federica D’Ambrosio is a Senior Trader and CFO at Audacity Capital. She graduated in Finance from Luiss University enhancing her knowledge on global markets completing a Master of Science at Fordham university in New York.