Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

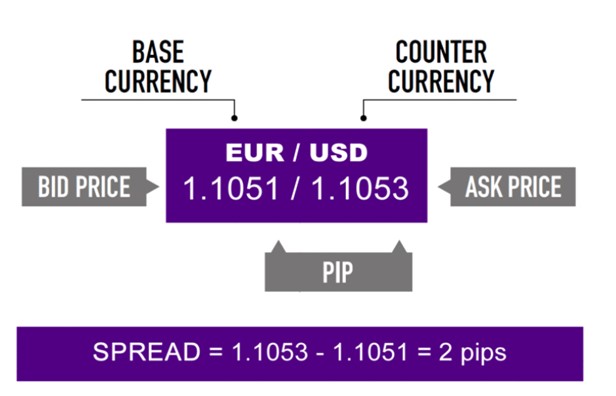

If you are like most beginner forex traders, you are probably asking yourself a lot of questions. One common question that puzzles many beginners is: should I trade with a larger or low spread? The thing is that low spreads is a very attractive feature in forex trading. This is because, with low spreads, there is a low risk and reward ratio.

Many professional traders like to trade forex pairs with lowest spread because they believe it is much easier to make money when the spread is low. These traders choose forex pairs with low spreads because they want to make money quickly without putting too much capital at risk.

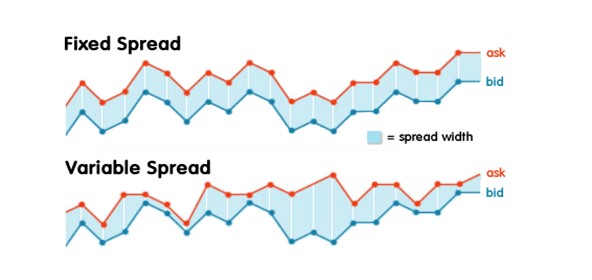

In other words, forex spreads are extremely important to traders because they determine how much money you will lose or make on each trade. Spreads can be wide, which means that they are large, or they can be narrow, which means that they are small and more profitable. The wider the spread, the higher your risk of losing money because you need to pay more than you would otherwise.

With a narrow spread, it’s easier to make money because you only need to pay a small amount of money to execute your order. That is why Audacity Capital recommends beginners to start trading pairs with low spreads because it gives traders a better chance at making profits on their trades. If you are a new trader, keep reading this article to know the best forex pairs with the lowest spreads.

EUR/USD is one of the most traded pairs in the forex market, and it is also best for beginners as it has a very low spread. This means that traders can start with a small capital and still make reasonable profits with this pair. The EUR/USD has a 20% trading volume in the market, and its variable spreads are around 0.1 to 3 pips, while its fixed spreads range from 1.3 to 5 pips.

The good thing with choosing EUR/USD pair is that it is very volatile. Even with the low spread, you can make a significant profit within a short time. The USD currency is normally triggered by news events, political events, social media, and the economic calendar. The same also applies to the EUR currency.

Having a mix of these currencies makes trading fun as long as you know how to open and close positions accurately.

If you are looking for forex pairs with lowest spreads tradersway broker offers, you should consider trading with GBP/USD pair. With the pair, you can get about 2.0% profit daily if you use the correct strategies.

What makes this pair unique is its big movements in the market. This means that even with the low spreads, it could give you significant profits if you combine it with a liquid market and good trading strategy. The GBP/USD has a variable spread of about 0.3 to 2.7 pips, including commissions. Also, the amount of losses you may make on a daily basis with this pair may be lower than that of other forex pairs because of its low spread.

After the EUR/USD pair, USD/JPY is the second forex pair with lowest spreads. The good thing about trading with this pair is that the two currencies have a strong economy. One deals with exporting (Japan), while the other is a big importer of different products. This means that this pair is very volatile, and you could find some great opportunities as you boost your trading skill.

The average variable spread for this currency pair is 0.2 to 2 pips. With this pair, you can yield better profits if you specifically focus on the two economies. If you get a broker offering three digits or an average of 1 pip, you could potentially make at least 2.1% daily profit.

This non-USD pair also has a low spread and can be suitable for trading if you are familiar with the economies. However, note that this pair is very sensitive due to its big movements. Anytime you use this pair, expect some major movements in the market. The advantage of trading with this pair is that your losses will be minimized because of its low spread. EUR/JPY has a daily range of 1.9% in terms of profit. This means that its spread ranges from 0.5 to 5.7 pips.

USD/CHF is a pair that is well know for its stability but do not assume that there are no opportunities available when trading with this pair. This pair can offer a daily profit of about 2.6% as its spread ranges from 0.5 to 5 pips.

The best part of using the USD/CHF pair is that it is an easy-to-follow currency pair because it is more stable than other forex pairs.

While spread matters a lot in forex trading, the best way to find the right pair is to look at the charts and see which ones have the most potential. It is wise to begin with pairs with understandable historical data to make your work easier while using the pair. So, is spread of a pair good or bad?

According to many professionals, choosing the right spread in a forex pair matters a lot as it will determine your profits and losses. Therefore, spread is a good thing as it helps minimize risks.

When a broker increases the spread, there will be higher profits on each trade. However, you will need to pay more when buying that pair.

Starting with a low spread pair means that you do not have to invest a huge capital, and it also minimizes your risks.

If you want to avoid spreads when trading, you need to follow the news of a particular currency pair you wish to trade. Once you know what is happening in the market, avoid trading before or immediately after the news.

A.Karim Yousfi is a experienced trader and analyst. He is managing a team of 5,000 traders at Audacity Capital London Trading Floor.