Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Currency Pairs

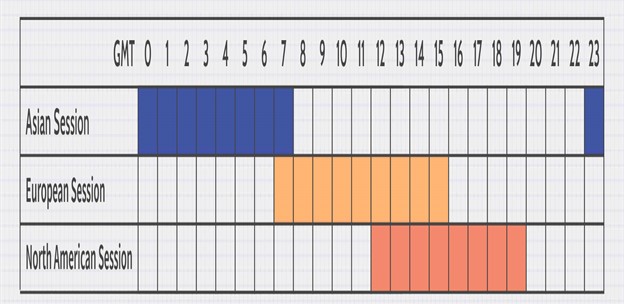

Forex trading is the conversion of a single currency to another. Also known as FX trading, it is one of the most active markets worldwide, attracting more than $5 trillion. It consists of a network of buyers and sellers. The forex market is a 24-hour trading platform. However, it is divided into different categories. The main categories include

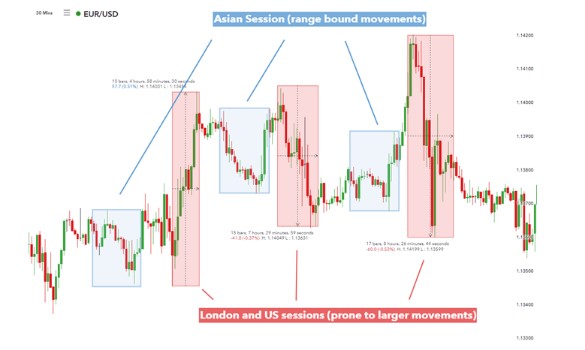

The Asian session is slow and tough to trade in compared to the European and North American sessions. Therefore, traders need to know the best forex pairs to trade in due to the low volume and high spreads characterizing the session.

It is important to note that the Asian session can be referred to as the Tokyo session. Japan is the third largest forex trading center making Yen the third most traded currency. It contributes 16% of all forex transactions.

Considering pairs with the Japanese Yen when trading during the Asian session is important. The trading strategy may also determine the pair to choose. However, traders who wish to make more profits should consider trading with other Asian currencies. Some of the best pairs to trade in during the Asian session include:

When trading between the AUD and JPY, it is important to consider all the market fundamentals to determine the best time. The Tokyo session provides the optimal time to trade since it offers high liquidity. The pair is highly volatile and subject to price fluctuations. Therefore, it is important to identify the periods when volatility is high.

The EUR/JPY is one of the most popular trading pairs across the world. It contributes up to 3% of the daily transactions, making it the most traded currency pair in the market. Most traders prefer this pair due to the high levels of volatility. This characteristic provides it with more trading opportunities.

The JPY/USD represents two of the most popular world currencies. Several factors affect the pair’s price since they originate from two globalized economies. Traders preferring this pair have access to various resources and information to help inform their trading decisions.

Its popularity also makes it the best for any trading strategy. However, it is important to choose a solid strategy since a slight market shift can have significant gains or losses.

The Asian trading session begins trading every Monday at 0000hours GMT. The session overlaps with the Sydney session, which starts two hours before the Tokyo session. The trading session overlaps with the London session during the last one hour. Therefore, the Asian session becomes more active during the Tokyo/London crossover.

Determining the best currency pair can be challenging. The best pairs should represent some of the most successful economies globally. However, avoiding non-Asian currency pairs during the Asian trading session is important. Some of the best currency pairs include;

According to inter-market analysis, it is best to manage risks. Trading with several currency pairs could be detrimental. Therefore, one should not trade in more than three pairs. Trading in a few currencies helps you spend more time analyzing each pair giving you a good understanding before taking action.