Forex trading requires consistency, patience and you must also have the best strategies to win in the market. But above all, you need to make a good decision on which currency pairs you will trade. This is because forex pairs usually affect the trading strategy and risk management.

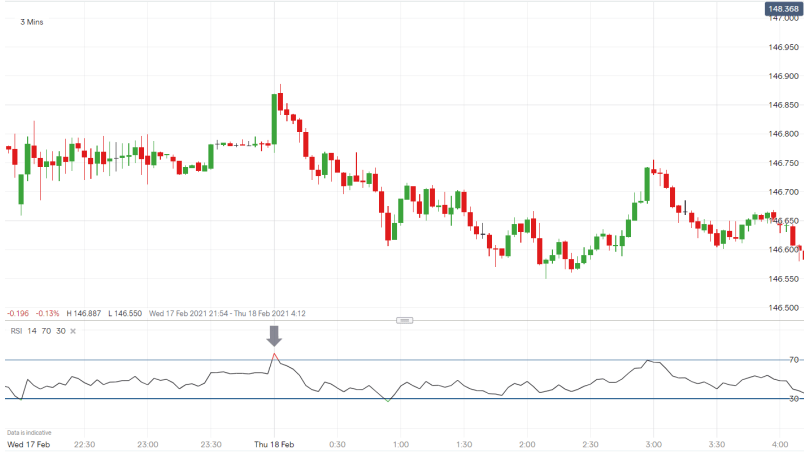

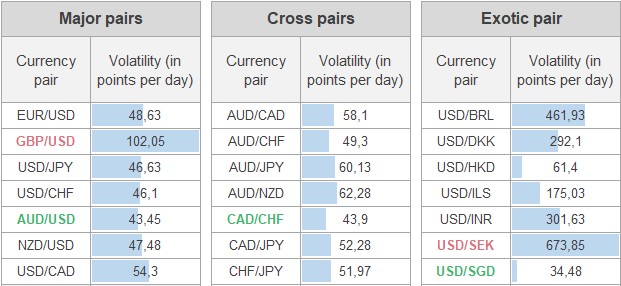

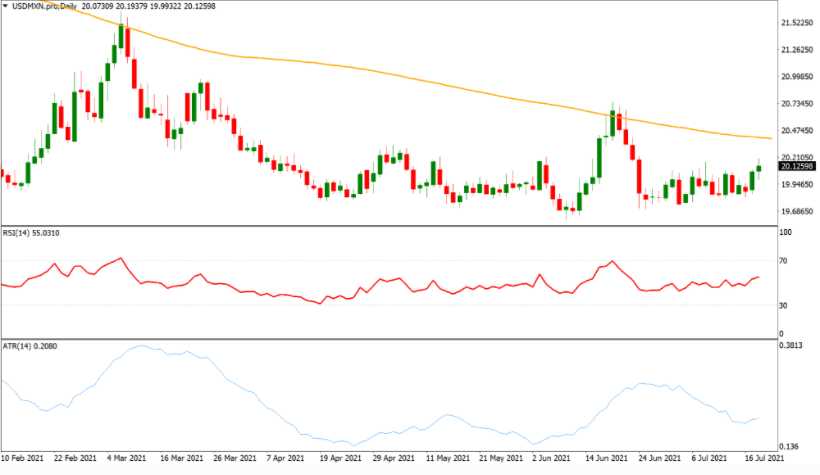

When choosing currency pairs, you need to think about a few factors, like volatility. Not all currency pairs have the same volatility, some are considered the most volatile currency pairs than others, and there is a reason for that.

The most volatile forex pairs can give your more profits or bigger losses. Because of this, you need to be very careful when picking them. Here in this article, you will learn more about volatility, how it comes about, and some of the most volatile currency pairs available.