Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading Strategies

If you’ve been trading Forex for any length of time, you have heard the warnings about leverage. It’s right there in the Forex brokers’ terms of service, their brochures, and every Forex website. Any firms that offer leverage say that it’s a tool to help you increase your profits and not a guarantee to make a profit.

Many people think that leverage is a way to make more money. In reality, it’s just another trading tool. If used correctly, leverage can be an aid to your trading. If not used correctly, it can wipe out your account balance in seconds. But even if you’re using it correctly, there are still some things you should know about this powerful tool. One thing that most traders fail to understand is that the higher the leverage, the higher the risk.

Although leverage is a great tool for beginner forex traders, it is still possible to start trading Forex without leverage to minimize the risks. To understand more about Forex trading without leverage, keep reading this post to gain more insight.

Leverage in Forex is a tool that allows you to trade with more money than you actually have. This can be incredibly useful when you’re just starting, as it can increase the number of trades you can make and give you more opportunities to learn from your mistakes. Leverage is expressed as a ratio of the borrowed amount to the margin deposit required by your broker. For example, if you have $10,000 to invest and your broker requires a $1,000 minimum deposit, you have 100:1 leverage. This means that for every dollar you invest, you can borrow another $100 from your broker.

However, leverage can magnify losses, which can quickly eat up any profits you make. This is why it is sometimes better to trade Forex without leverage, but does it really work?

Trading forex without leverage may not be that fun, but it is sometimes necessary if you want to minimize losses. The problem is that no leverage forex trading is not accessible to many traders. Also, Forex without leverage means that the fluctuation in prices will directly influence your account, and the returns may be small. You will only be getting around 3 to 5% profits on a good trading day, which is way lower than what an average trader gets (10% profit).

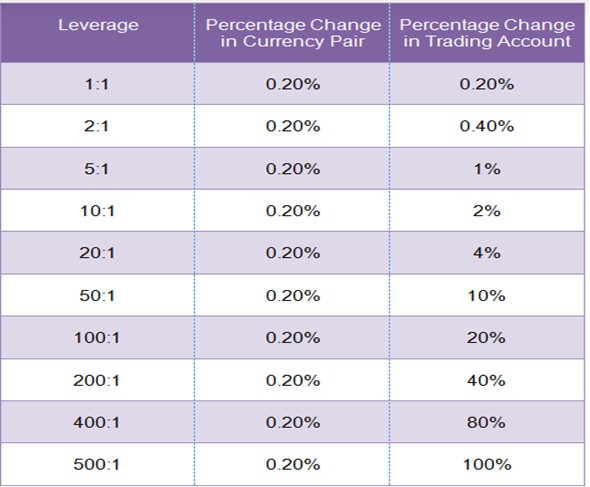

The reason behind the low returns is that currency pairs have low volatility compared to stocks. Currency pairs rarely change by more than 1 to 2%, meaning that if you do not use leverage, you will get a very small percentage of profit, depending on the amount you invested. Many traders who trade without leverage invest high amounts of money to get huge returns and minimize risks. This table will help you understand how leverage works;

The above table shows that the percentage change in currency pairs is very low, meaning that the higher the leverage, the higher the percentage change in your trading account. If you use a leverage of 50:1, your profits will be 10% of what you have invested. It also means that if the forex market moves in the opposite direction, you will incur a 10% loss. With the 500:1 leverage, you can either get 100% profits, or your entire account will be wiped off.

It is worth noting that the 0.2% currency change can happen within seconds or minutes, and you can make a loss or a profit. Professional traders who like to invest and hold large sums of money in their accounts sometimes prefer the no leverage forex trading policy.

Forex trading without leverage can produce substantial benefits, but it also comes with a few key disadvantages. The following is a list of the benefits and disadvantages of Forex trading with leverage.

After analyzing the advantages and risks of using leverage when forex trading, some traders prefer to use leverage, while others say no to it. The truth is that leverage is an excellent trading tool as it can help you gain huge returns. The problem is that it comes with high trading risks, and traders who own large trading accounts may not find leverage appealing.

For example, if you have an account with more than $100,000, you may find it very uncomfortable to risk the account with high leveraged trades. This is why many traders with large accounts prefer not to apply leverage in their trades. Even though they may experience losses along the way, it will be hard for them to blow the entire account.

Another group of traders that may benefit from not using leverage are those interested in earning from their savings. This group of traders does not always want to take huge risks in the market, so they prefer to earn from their deposit, which is always around 12% per year.

Also, stock traders do not necessarily have to use leverage. Unlike currencies that are not that volatile, stocks are volatile and can move by 5%, 10%, or even 20% on a good trading day. If it moves that much, buying stocks without leverage can be very profitable compared to Forex. Therefore, long-term stock investors can always invest their money without leverage. They will only have to wait for stocks to fluctuate by a higher percentage and then sell them without dealing with many risks in the market.

Many people prefer Forex trading to stocks trading because it is easy to understand and make profits. Audacity Capital also ensures that its learners understand the basics and technicalities of forex trading, ensuring they earn their first profit within a short period. It also funds its traders and spits profits equally.

Beginner traders are always advised to select good leveraged trades to earn profits. Besides, leverage helps newbies fund their trading accounts with the required trading amount. Therefore, leverage is a good thing if you need extra money to fund your account, but it is crucial to know that it can magnify your losses and should be used wisely.

On the other hand, if you are funding your trading account with a lot of money, like $200,000. It is good to consider trading forex without leverage to minimize risks. No leverage forex trading policy may not be for everybody, but it is essential to weigh your options and skills to avoid losing your trading account.

Although newbies are always advised to use leverage to grow their trading accounts, it is not always necessary. Beginners can trade without leverage and still profit so long as they have the required amount of money to start trading.

The amount of money you will make forex trading with no leverage depends on your invested amount.

If you use the day trading or swing trading strategy, you can still continue using the strategy without leverage.