Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading Strategies

The value of goods and equities are determined using the intrinsic strength on an absolute basis. However, the value of the foreign exchange is determined using the strength of one currency to the other. In finance, fundamental analysis has an essential role in the valuation process. For currency traders, the fundamental analysis examines the underpinnings of random exchange rate fluctuations.

There are three existing methods used to analyze forex trades. Some traders use the three combinations for forex analysis. These three types of analysis include:

Fundamental analysis in forex is the method used for price forecasting by studying the financial markets. It is an intricate and crucial method to understand the precise valuation of any investment, especially in currency pairs.

Forex fundamental strategy looks at the state of the economy and studies other factors such as interest rates, employment status, manufacturing, GDP, and international trade. It also looks at impacts on the national currency value.

The fundamental analysis is an overall umbrella that encompasses all crucial factors influencing price fluctuations. Therefore, it is essential to understand the foundation of the fundamental forex analysis.

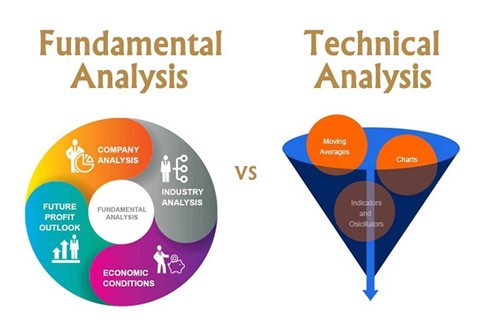

Foreign exchange traders rely on two basic analysis forms around the stock market. These include fundamental analysis and technical analysis. Technical analysis involves studying charts to identify patterns and strengths, while fundamental analysis involves studying news, headlines, and reports on economic data.

The forex fundamental trading strategies and other financial markets consider that the price of an asset may not be equal to the real value. Therefore, different markets may misprice an asset for the short term. However, regardless of the mispricing, the assets always fall back to their real price. Therefore, fundamental analysis’s main goal is to determine an asset’s real price and compare it with the current value.

The diagram below demonstrates the difference between forex fundamental and technical analysis. Technical analysis does not consider the current price. One major disadvantage of fundamental analysis is that it is not an ideal tool for a short-term trader or a day-to-day trader.

Forex fundamentals look at the currency’s interest rate. Traders looking at the fundamental releases should note how it affects the future of interest rates. When investors are risk-free, the yields increase due to higher interest rates. High-interest rates encourage investments.

On the other hand, when investors are in a risk-averse mode, they hide the money in haven currencies, thus reducing yields.

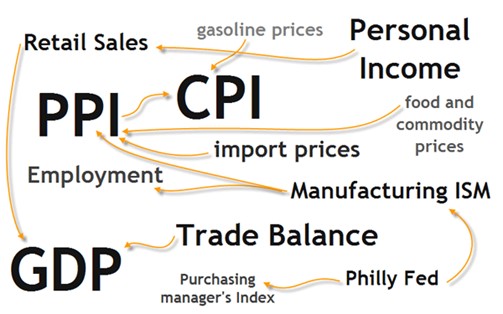

Economic indicators include reports from government and private financial institutions’ surveys. These reports act as a means of measuring the country’s economic health. However, several other factors can determine a country’s economic performance.

Countries release these reports on a scheduled basis to indicate whether the nation’s economy is dropping or improving. The reports align with the earning reports and SEC filings that may affect security exchanges. Similar to the stock exchange, a deviation from the norm can affect the overall price and volume.

The GDP measures a country’s economy, representing the total market value of goods and services produced. GDP can sometimes be considered a lagging indicator. Therefore, most trading experts focus on the last two reports before the GDP figure is released. A revision in the two reports can cause volatility in the market.

The industrial production report shows a country’s productivity of factories, mines, and utilities. The report also indicates capital utilization, which indicates each industry’s degree. A country uses this information to see whether it is at its maximum or near-maximum capacity utilization.

Most traders analyzing the report are usually concerned with utility production, which is usually volatile. The high demand for energy causes high volatility in the utility industry. Weather changes are one of the main factors that cause volatility in any nation’s currency.

Also known as CPI, it measures the changes in the process of consumer goods over 200 different categories. The report indicates whether a country is losing or gaining profits on its products and services. Most traders also focus on exports since export prices always change to match the currency’s strengths and weaknesses.

The report on retail sales shows the total receipts from all stores within a country. The value is derived from a wide sample of retail stores. The report plays an integral role as an indicator of consumer spending patterns.

The report provides an immediate direction of an economy and can predict the performance of other lagging indicators, such as the GDP.

Interest rates play a key role in fundamental forex trading strategies. Different types of interest rates exist. However, forex trading focuses on the country central bank’s nominal or base interest set. Central banks are responsible for money production, which private banks borrow.

The base or nominal interest rate represents the fee paid by the private banks on borrowed money. Interest rate manipulation is a big part of the national monetary policy. It is one of the main functions of the central banks since the interest rates play an important role in levelling the economy.

Economic indicators are the main factors used to gauge the economic state of every country. However, they are not the only things that affect the currency price. Therefore, changes in the indicators’ conditions can directly affect the country’s currency.

One should consider various things when conducting fundamental analysis in forex trading. These aspects include:

Forex signals are cues to either sell or buy currency at specific times. The signals are derived from technical and fundamental analysis, making them an invaluable section of the trading plan. The signals are available in the public domain. One can obtain them from third-party vendors or by custom building.

Audacity Capital is one of the leading forex signals providers. It provides investors with actionable trading ideas within the online platform. The company has a verifiable and extensive record of accomplishment that meets all the criteria to ensure that the methodologies used are sound.

Are you ready to apply the new knowledge concerning fundamental analysis in forex trading? Use Audacity capital live trading account. The online platform has over 2000 markets and provides you with the latest news and analysis.

Audacity Capital is an award-winning platform registered globally as the leading forex broker. It offers several strategies and trading instruments through MetaTrader 4 and 5.

Three major analysis types in forex trading include:

Several indicators can be used in fundamental analysis. Some of the main indicators include:

Technical analysis is the study of price movements, while fundamental analysis is the study of what moves the price.

A.Karim Yousfi is a experienced trader and analyst. He is managing a team of 5,000 traders at Audacity Capital London Trading Floor.