Why should you join our Funded Trader Program?

- Fully funded trading account.

- Big profits 50-50 % profit split.

- Mobile International Trading.

- You’re not liable to losses.

- 10% Drawdown.

- Robust Technology and Deep Institutional Liquidity.

Forex Trading Strategies

Forex traders usually take the time to study the market before deciding which strategies to use while trading. This is crucial as it determines whether the trader will make a profit or not. Many traders enjoy forex scalping as it involves quick profits, but this also means they need to find the best forex scalping strategy to make more profits.

Finding the best forex scalping strategies can be quite challenging, especially if you are a beginner. This is why this article is here to help you know some of the best scalping forex strategies and why you need to use them.

Forex scalping is a type of trade that several forex traders use to make profits quickly. The thing is that they must use the best forex scalping strategy to achieve these small winnings. Forex scalp strategy focuses on small payouts, and scalpers usually close their positions after attaining 5 to 20 pips.

Scalper forex strategy utilizes minor price movements, and therefore, scalpers must make several trades in a day, which are usually present throughout the day. This allows them to end their day with a considerable amount of profit. The most important thing is to apply forex best scalping strategy depending on the market condition.

It is crucial to look for a simple scalping strategy forex traders use to stay profitable in the forex market. Having the best strategies will allow you to achieve your goals and guide you through the trading process. Here are other reasons why you should consider using scalping forex strategies:

Forex scalping is not for everybody. You must be able to sit behind your computer for hours and also think and act quickly. This is why you need a simple forex scalping strategy that will guide you and help you avoid mistakes. Remember, you will be placing trades throughout the day, and sometimes it can become demanding. A good strategy will help ease your work.

In forex scalping, you can make a lot of profits, but then again, you can also make losses. Like other trading styles, this one is also risky, and that is why many traders consider using the best forex scalping strategies to ensure they are making consistent profits. Another thing is that scalping strategies help you avoid big losses as it allows you to know where to set your stop loss.

Many beginners are afraid to trade on a live account because they may lose all their money. Forex strategies that work help minimize risks, and beginner traders also get to understand risk management skills while using these strategies.

Many traders usually ask, “What is the best timeframe to scalp forex?” Although the currency does not always affect scalp trading timeframe, many traders prefer to look at the currency to know when they will scalp trade. For example, when trading a GBP currency pair, it can be successful during the mid-morning hours of the London trading session.

According to other sources, it is best to trade during the first hours of the New York trading session. This is because US dollars have a high trading volume. Some professional scalpers also trade during the morning hours because the market is very volatile. It is not advisable for beginner traders to pick this session. Instead, you can always use scalping indicators to determine the best time to trade.

So, what is the best indicator for forex scalping? There are five indicators that you can always use with your forex trading scalping strategies. They include:

This usually helps to show volatility in the market. It uses Simple Moving Average and standard deviation to indicate a volatile market. Many traders believe that when the standard deviation is wide, it shows improved volatility, but the market is very stable the bands are narrow. The thing is that when it is used with other scalping strategies, it can be very effective.

Moving average is a formula that spots common and emerging trends in the forex market. Usually, there are two kinds of MA: the Exponential moving Average and Simple Moving Average. Traders love them since they are easy to read. What happens is, traders, select short-term and longer averages to determine a market trend.

This is yet another indicator that is usually used to predict if a trend will become bullish. It uses the current value of currency pairs and compares it to its recent range on a specific period.

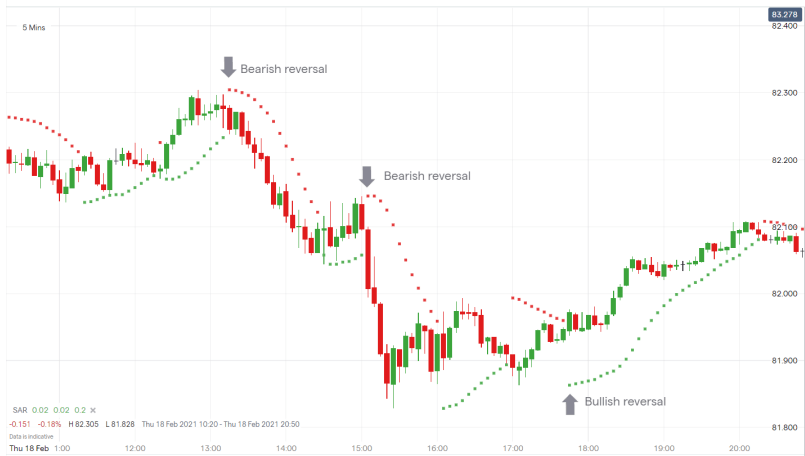

Scalpers usually use this technical indicator to know when is the right time to enter or exit a trade. The indicator is presented as dots at the top and bottom of the market price. The red dot represents the sell signal, while the green dot acts as a buy signal. Using this indicator and scalping strategy, forex scalpers can easily open or close a position.

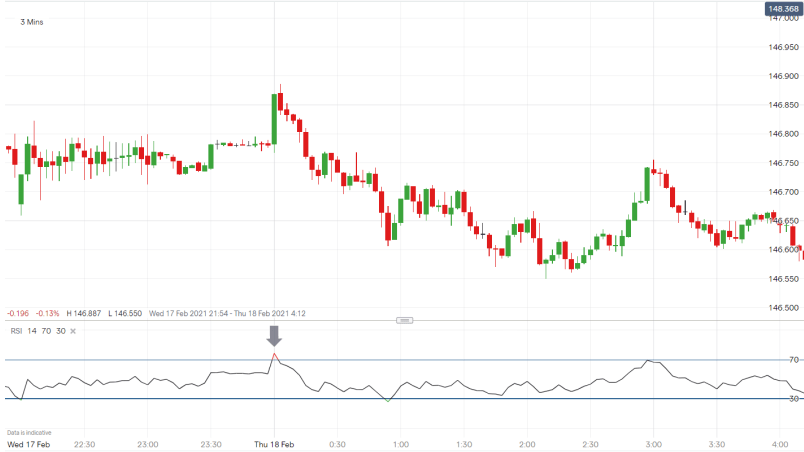

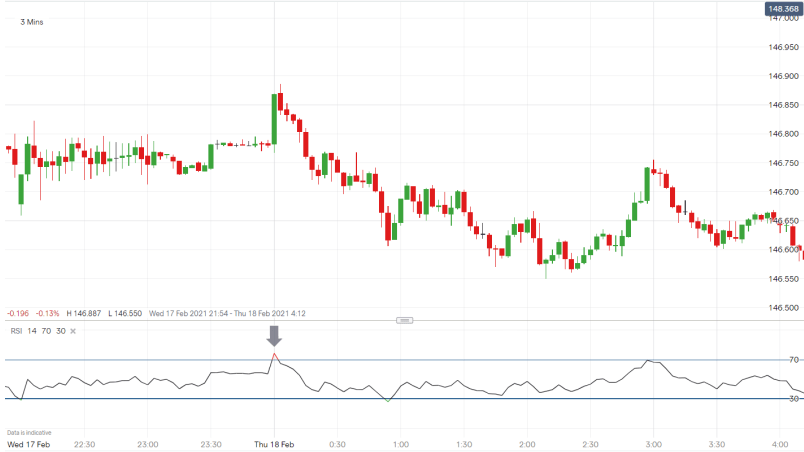

Relative Strength Index is the last indicator scalpers can use. It helps them know whether a market can change direction. The indicator ranges from zero to 100, and the resistance and support levels are set between 30 to 70, respectively. If the RSI goes above 70, the market is overbought, and therefore, a scalper may benefit by going short. On the other hand, if RSI goes below 30, the market is oversold, and traders will benefit if they go long.

Is forex scalping profitable? There are many forex strategies scalping traders can use to make profits. Even though the return may not be huge, in the long run, you can make a lot of profits with the following strategies:

Trend trading is about going in the direction of a trend to make a profit if the trend progresses.

Pros:

Cons:

This strategy focuses on resistance and support. A scalper buys near the support and sells near the resistance. It is the best forex trading strategy according to many scalpers, especially the beginners since there are very minimal risks involved:

Pros:

Cons:

Momentum trading is another scalper strategy forex traders use. It involves investing in securities that are on the rise and selling them when they have fully peaked.

Pros:

Cons:

A well-chosen forex scalper strategy will work, and there are several traders making money using scalping strategies.

Scalping a high momentum trading, and you should never scalp trade if you feel unfocused.