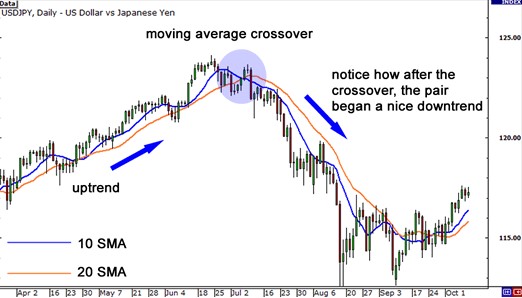

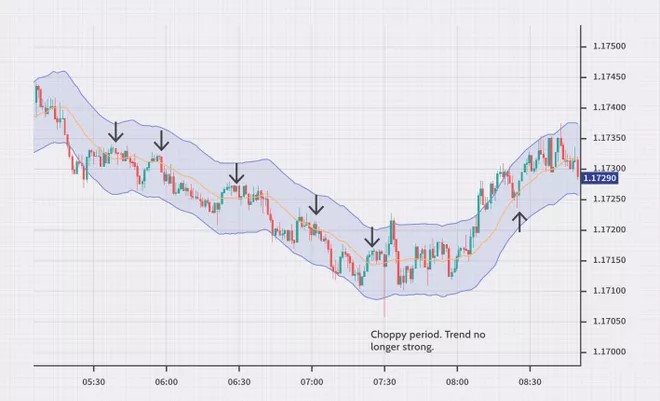

Forex moving average is a lagging indicator as it relies on past prices. The strategy has been there for a long time. They are easy to measure, apply and test. This makes the moving average a great modern trading strategy that can accommodate both the fundamental and technical analysis.

There are two types of forex moving averages strategy traders use. They include the Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

These two averages differ slightly, especially when it comes to speed and how they are calculated.

What is EMA in trading? Exponential Moving Average provides more weight to the recent price action, while the Simple Moving average is the simple average of forex pair’s movements. Some traders prefer the EMA over SMA because it better indicates the things happening in the market.