The currency pairs that are majorly traded in the FX market are derived from the world’s most powerful economies. That is from America, Europe, Canada, Japan, and Australia. Each one generates a unique economic profile which tends to make their currencies behave differently. The value of each country’s currency directly impacts the country’s economy and affects many other aspects of our daily lives. The USD is the most commonly traded currency as it affects us in many ways.

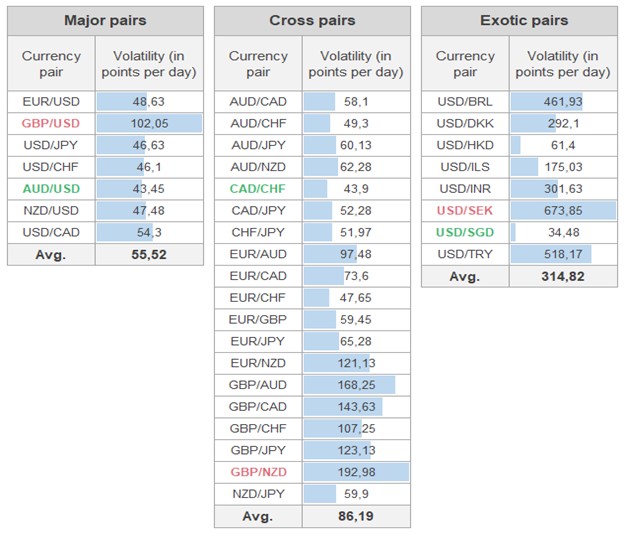

USD being one of the major currencies in the market, it offers traders an opportunity to trade against other major currencies like EUR, JPY, GBP, etc. But while most traders use major currencies to trade in the FX market, others prefer to use exotic pairs. Forex exotic pairs exist to satisfy the needs of traders who want to take advantage of markets that exhibit specific characteristics, such as those related to risk, liquidity, and volatility. If you also wish to understand more about exotic currency pairs and trade using them, keep reading to understand everything about them.